Business Income Tax Malaysia

Once you ve registered your side business it will be recorded on form b.

Business income tax malaysia. The corporate tax rate in malaysia stands at 24 percent. For deductibility of interest expense in a cross border controlled transaction. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in malaysia. No other taxes are imposed on income from petroleum operations.

On the first 2 500. On the first 5 000 next 15 000. There are no other local state or provincial. Deduction of tax on the distribution of income of a unit trust 109 e.

For the be form resident individuals who do not carry on business the deadline for filing income tax in malaysia is 30 april 2020 for manual filing and 15 may 2020 via e filing. Remember you file for 2018 income tax in 2019. Both your employment and business income can be captured on this form. This page provides malaysia corporate tax rate actual values historical data forecast chart statistics economic calendar and news.

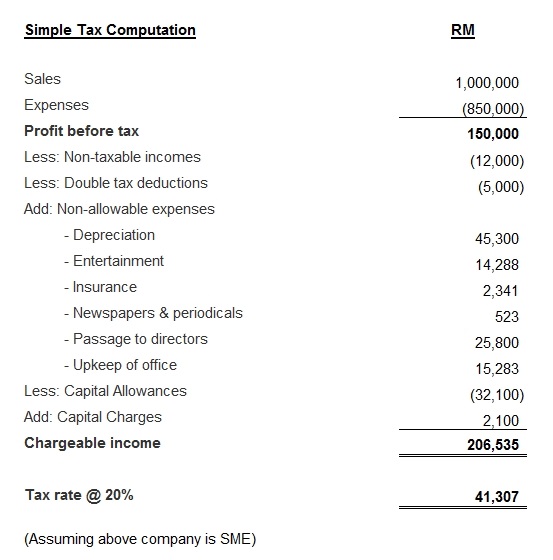

Deduction of tax from gains or profits in certain cases derived from malaysia 109 g. The deadline for filing your income tax returns form in malaysia varies according to what type of form you are filing. Calculations rm rate tax rm 0 5 000. If you are an individual with non business income choose income tax form be e be and choose the assessment year tahun taksiran 2018.

An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields. Corporate tax rate in malaysia averaged 26 21 percent from 1997 until 2020 reaching an all time high of 30 percent in 1997 and a record low of 24 percent in 2015. Capital allowance tax depreciation on industrial buildings plant. If you have never filed your taxes before on e filing income tax malaysia 2019.

Income derived from sources outside malaysia and remitted by a resident company is exempted from tax except in the case of the banking and insurance business and sea and air transport undertakings. If you re still unsure which type of business you should register as we recommend checking out our article on the different types of business entities in malaysia. Deduction of tax on the distribution of income of a family fund etc.