Overnight Policy Rate Malaysia Meaning

Overnight policy rate opr is the interest rate at which a depository institution lends immediately available funds balances within the central bank to another depository institution overnight.

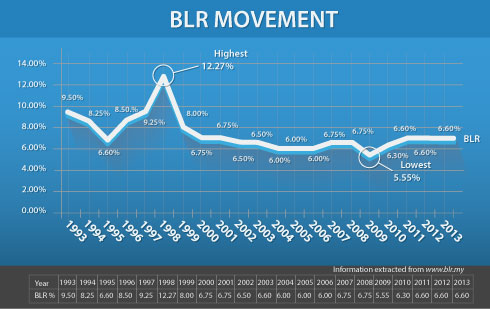

Overnight policy rate malaysia meaning. Economic and financial developments. Please refer to the box article entitled the redefinition of external debt in the bank negara malaysia quarterly bulletin. Mgs gii t bills etc which was classified as domestic debt under the previous definition 6 refers to non resident holdings of ringgit denominated. The overnight policy rate is an overnight interest rate set by bank negara malaysia bnm used for monetary policy direction.

This is an efficient method for banks around the world to practice accessing short term financing from the central bank depositories. The current opr set by bank negara is 3. The adjustment to the opr is a pre emptive measure to secure the improving growth trajectory amid price stability. The monetary policy committee mpc of bank negara malaysia decided to reduce the overnight policy rate opr to 2 75 percent.

This overnight policy rate or interest rate is a rate a borrower bank has to pay to a leading bank for the funds borrowed. You may wonder why a bank would be borrowing from another bank but you must understand that bank makes money by lending money out and not by keeping money. Bank negara malaysia bnm announced another reduction of the overnight policy rate opr by 25 basis points to 1 75 on july 7 2020. This is the fourth time the opr has been decreased this year pushing it to a record low.

-in-Malaysia/OPR-(Banner).png.aspx?width=700&height=162)