Personal Tax Relief 2018

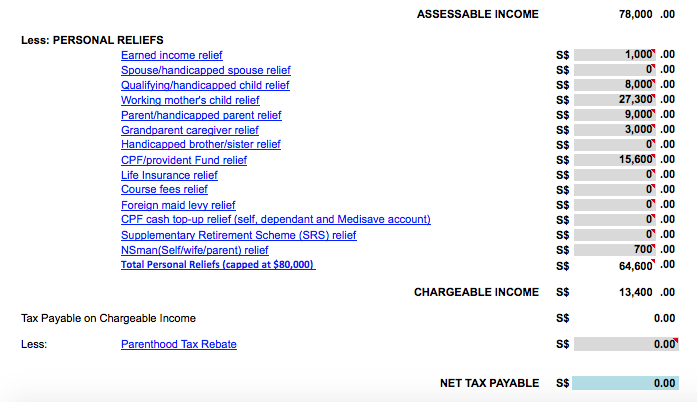

As the total amount of personal reliefs claimed by mrs chua exceeds the overall relief cap of 80 000 the total personal reliefs allowed to her is capped at 80 000 for ya 2018.

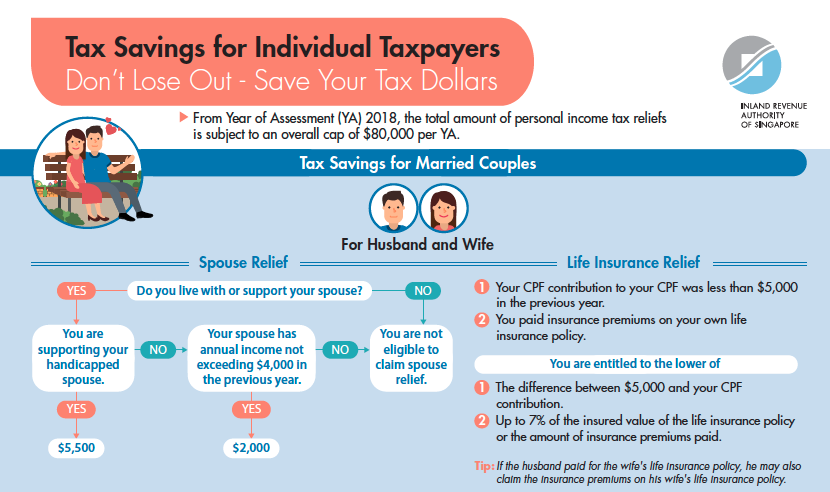

Personal tax relief 2018. A tax relief is an incentive that reduces the amount of tax that a person has to pay. Note that this cap only applies to personal reliefs. There is an increase in tax payable of 797 44 900 102 56 for mrs chua from ya 2017 to ya 2018 due to the relief cap. From year of assessment ya 2018 the total amount of personal income tax reliefs which you can be allowed is subject to an overall relief cap of 80000 per ya.

Personal income tax relief cap. Medical expenses for parents. As the clock ticks for personal income tax deadline in malaysia 2018 like gainfully employed malaysians you may have started visiting the lhdn malaysia website to do your e filing as both a proactive and precautionary measure. Amount rm 1.

You should continue to claim the personal reliefs if you have met the qualifying conditions. This relief is applicable for year assessment 2013 and 2015 only. Kenya revenue authority wishes to notify employers employees and the public of the following changes that were introduced under the finance act 2017 effective 1st january 2018. Individual income tax bands and resident personal relief.

28 800 per annum kshs 2 400 per month with effect from 25th april 2020. If you already reached this cap taking further steps to boost personal reliefs will not reduce your tax bill. This guide is for assessment year 2017 please visit our updated income tax guide for assessment year 2019. Revised individual tax bands and rates.

Every resident individual is entitled to an insurance relief of 15 of the amount. 5 000 limited 3. A new policy that took effect from ya 2018 is the personal income tax relief cap which limits the total amount of personal reliefs an individual can claim to 80 000 per ya. Every resident individual is entitled to a personal relief of ksh.

Self and dependent special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually. Each relief serves an objective. Today there are 15 tax reliefs. Please note that for each year of assessment ya a personal income tax relief cap of 80 000 applies to the total amount of all tax reliefs claimed including relief on srs contributions.

The previous laptop books stationary and sports equipment tax relief is now grouped under lifestyle tax too. The government has added a lifestyle tax relief during the 2017 budget which now includes smartphones tablets and monthly internet subscription bills. But taken together the reliefs can unduly reduce the taxable income. Refer to this list of the income tax relief 2018 malaysia.

.jpg)